17th April 2023

general

So how does it work, and how can you incorporate pound cost averaging into your investment plan?

What is Pound Cost Averaging?

The idea behind pound cost averaging is simple. It means that you invest regularly over a period of time, during which, the market will rise and fall.

If share prices go up, your existing pot will benefit as the value will rise. But if prices go down, you will be able to buy more shares with your regular investment, boosting your eventual fund value.

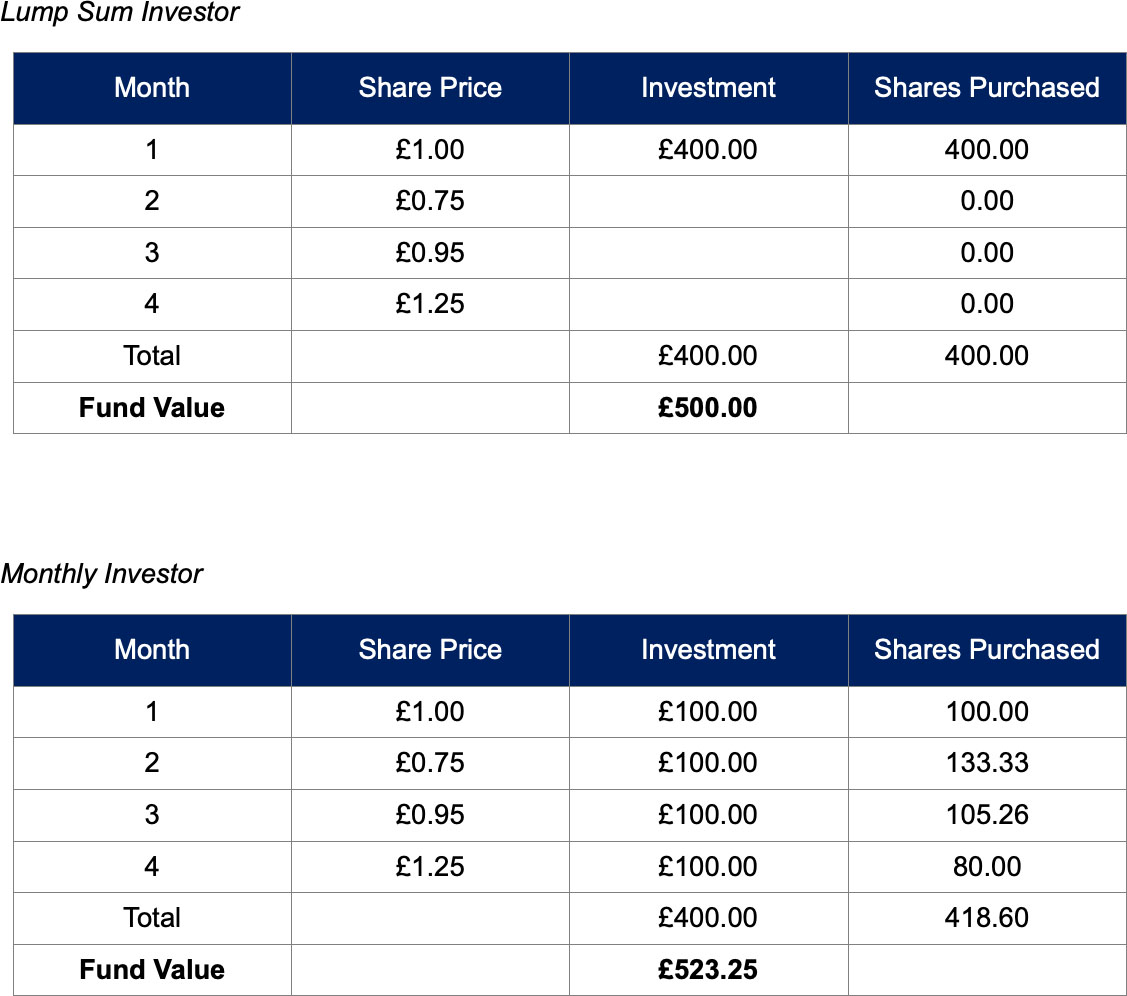

Let’s take a very simple example:

In this scenario, the market dips shortly after the first investment. The lump sum investor loses money in the first instance, although the market eventually recovers and they start to see returns.

The regular investor also loses money in the first month, but because they haven’t put all of their money into the market, the impact is lessened. In month two and three, they can actually buy more shares due to the reduced prices. They eventually end up better off than the lump sum investor as they have benefited from both the high and the low points in the market.

Of course, if share prices had steadily risen, the lump sum investor would have ended up with a larger pot. But while prices do tend to increase over the longer term, this never happens in a straight line. We expect to see ups and downs on a monthly basis.

The monthly investor has also reduced some of the risk. As the lump sum investor discovered, the market can fall at any time. If this happens just after you invest, it can take some time for the funds to recover.

The Psychological Benefits

Pound cost averaging is also a useful tactic from a psychological perspective.

Firstly, investing every month is a good habit to get into. You are more likely to stick to an investment plan if you set up a direct debit and avoid thinking about it too much. This helps to build discipline without too much effort.

Additionally, pound cost averaging means that you are not having to make decisions about when to buy and sell. There is no best or worst time to invest as the fluctuations happen daily. Trying to time the market is not only mentally draining, but it is rarely effective. By the time the public becomes aware of something that could affect a share’s value, it is already priced in. Any advantages gained due to market timing are purely down to luck, and are unlikely to be sustainable for the long-term.

Investment decisions can sometimes be driven by emotion. Investors may feel that they should invest more when the market is rising, and may be tempted into selling when things take a downturn. Getting it wrong (which happens more often than not) can be devastating, particularly if you are investing a significant sum. Investing regularly, through the ups and downs, can ease some of this pain.

A good investment plan thrives on discipline rather than emotion. Pound cost averaging can help to instill this.

What If You are Investing a Lump Sum?

If you invest a lump sum, and the market steadily rises, your investment will grow. But the market could just as easily fall the day after you invest. There is a strong chance that it will recover eventually, but it will take some time.

Lump sum investors can still benefit from pound cost averaging. You can drip feed your investment into the market over a period of months. In the meantime, you will be earning interest on your cash.

You may wish to consider this if you are investing a large amount or if you are nervous about investing all in one go.

Other Ways to Boost Your Returns

Pound cost averaging can boost your returns over the longer term, as well as mitigating some of the risks. However, there are a few other tips you can use to improve your returns:

If you need some help with your investment strategy, or would like an objective view of the best options, it may be worth seeking financial advice.

Please don’t hesitate to contact a member of the team to find out more about investing.