13 November 2024

general

Here in Bristol, Wallace and Gromit might be two of the most well-loved TV characters of all time. The cheese-loving inventor and his long-suffering dog are celebrated throughout the city. You might already be looking forward to watching their latest adventure, Wallace & Gromit: Vengeance Most Fowl, when it hits screens this Christmas.

The characters’ creators have been on a rollercoaster themselves ever since their early short films graced our screens. As well as earning themselves a whole host of awards, Aardman Studios has become a household name across the world, but they’ve also encountered setbacks along the way.

With so much history behind them, it’s unsurprising that Aardman Studios can teach us a lot about a whole host of subjects, one of which is effective financial planning.

Read on to discover some of the insightful financial lessons you could learn from Wallace and Gromit’s creators.

1. Take a long-term view of investments to benefit from compound returns

Wallace and Gromit first appeared on TV in 1989, and since then have proved to be a popular crowd-pleaser, whether they are flying to the moon, outsmarting villains, or battling the “were-rabbit”. Now, 35 years after their first TV appearance, the duo is set to return to screens for another feature-length film this Christmas. So, it’s safe to say that the characters have stood the test of time.

The fact that Wallace and Gromit continue to delight audiences around the world provides a helpful analogy for investing. We usually recommend holding investments over the long term – ideally a minimum of five years – so that you stand the greatest chance of your portfolio generating positive returns and benefiting from compounding.

Compounding is the process of generating returns upon returns. In other words, if you invest money for one year, you’ll (hopefully) generate a return on that investment. If you leave the initial deposit and the returns invested, in the second year you’ll generate returns on the total balance. Over time, this can help to grow your wealth much more quickly than if you were to take your money out after a short time.

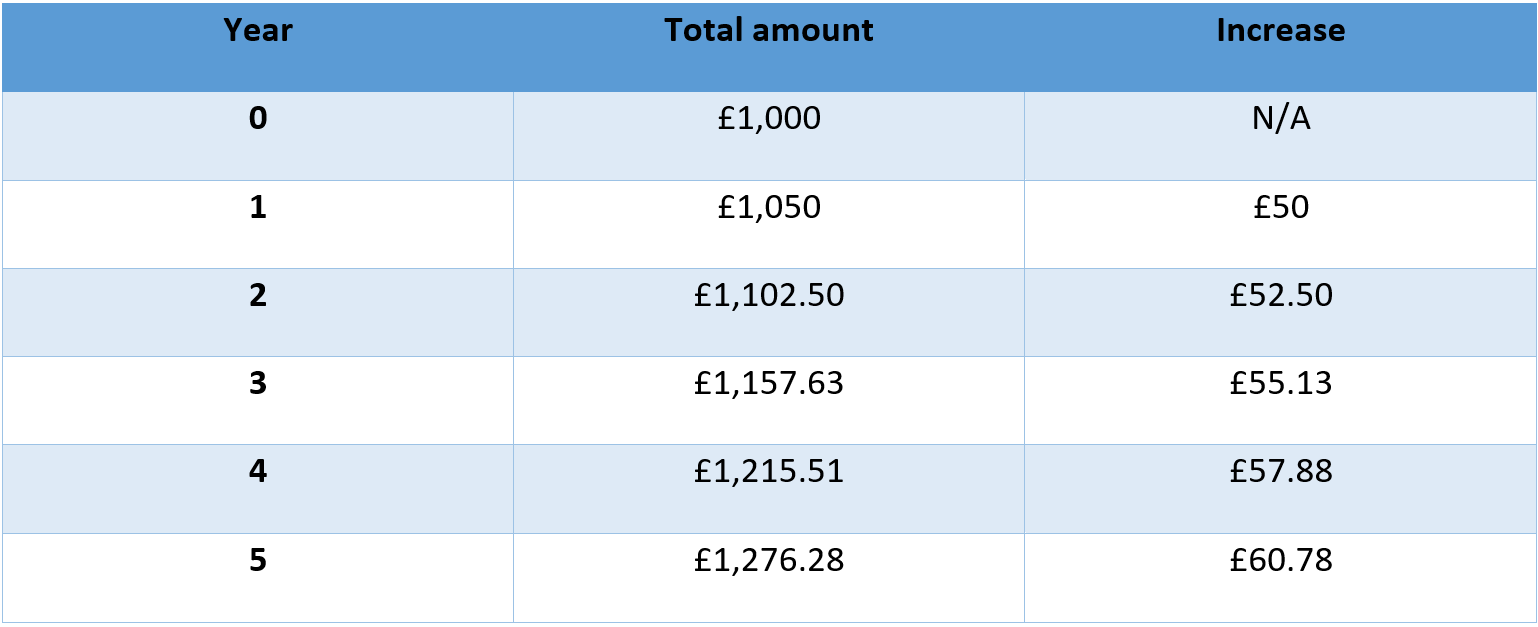

The table below demonstrates why compounding can be so beneficial for investors. It assumes an initial investment of £1,000 that grows by 5% a year excluding fees.

Source: Vanguard

You can see that the increase in the total balance is greater each year because it generates returns on the whole sum, including previous returns.

As such, taking a long-term view of your investments could help you grow your wealth and make progress towards your financial goals.

2. Financial protection is crucial in case disaster strikes

In 2005, a fire swept through a warehouse that contained many of Aardman’s creations, including film sets, storyboards, and plasticine models of many beloved characters. Thankfully, many props and models were housed elsewhere or were being shown in exhibitions, but the fire was still a tragic moment in Aardman’s history.

Throughout your life, you might be faced with unforeseen challenges that have a significant impact on your wealth or your ability to continue working towards your goals. For example, you might become unexpectedly unable to work due to an illness or injury.

If this happens, you could face:

Financial protection can create a helpful safety net for you if something like this happens. If you fall ill or are unable to work, you could receive a lump sum or regular payout to help you cover your regular expenses and pay for things like private medical care or adjustments to your home.

As well as these practical aspects, financial protection can provide valuable peace of mind that you and your family’s financial wellbeing needn’t be affected if you’re unable to work.

3. Make sure your financial plan is tailored to your priorities and goals

From 2000 to 2007, Aardman joined forces with Dreamworks to create a series of stop-motion feature films. The partnership produced a host of family favourites, including Flushed Away, Wallace & Gromit: The Curse of the Were-Rabbit, and the highest-grossing stop-motion feature film of all time: Chicken Run.

Despite these successes, Dreamworks and Aardman chose to part ways in 2007 as a result of creative differences, with each maintaining that their business goals were no longer in alignment.

In much the same way, it’s vital to put your personal goals at the centre of your financial plan and make decisions about your wealth that are right for you. Even if your friends or relatives have similar goals, the way you choose to go about achieving them may differ. Factors that can affect this include:

So, even if others are experiencing success with a particular investment or financial product, it doesn’t necessarily mean this will be right for you. Your adviser can help you identify the most sensible choices to help you achieve your goals.

Get in touch

For cracking financial advice to help you avoid getting down to your last few coppers in retirement, please get in touch to find out how our advisers can help. Email enquiries@jesellars.co.uk or call 01934 875 919 to learn more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.